P

RODUCT

CENTER

Model:

PS101Z501

Screen Size:

10.1 inch

Resolution:

1024*600

Controller:

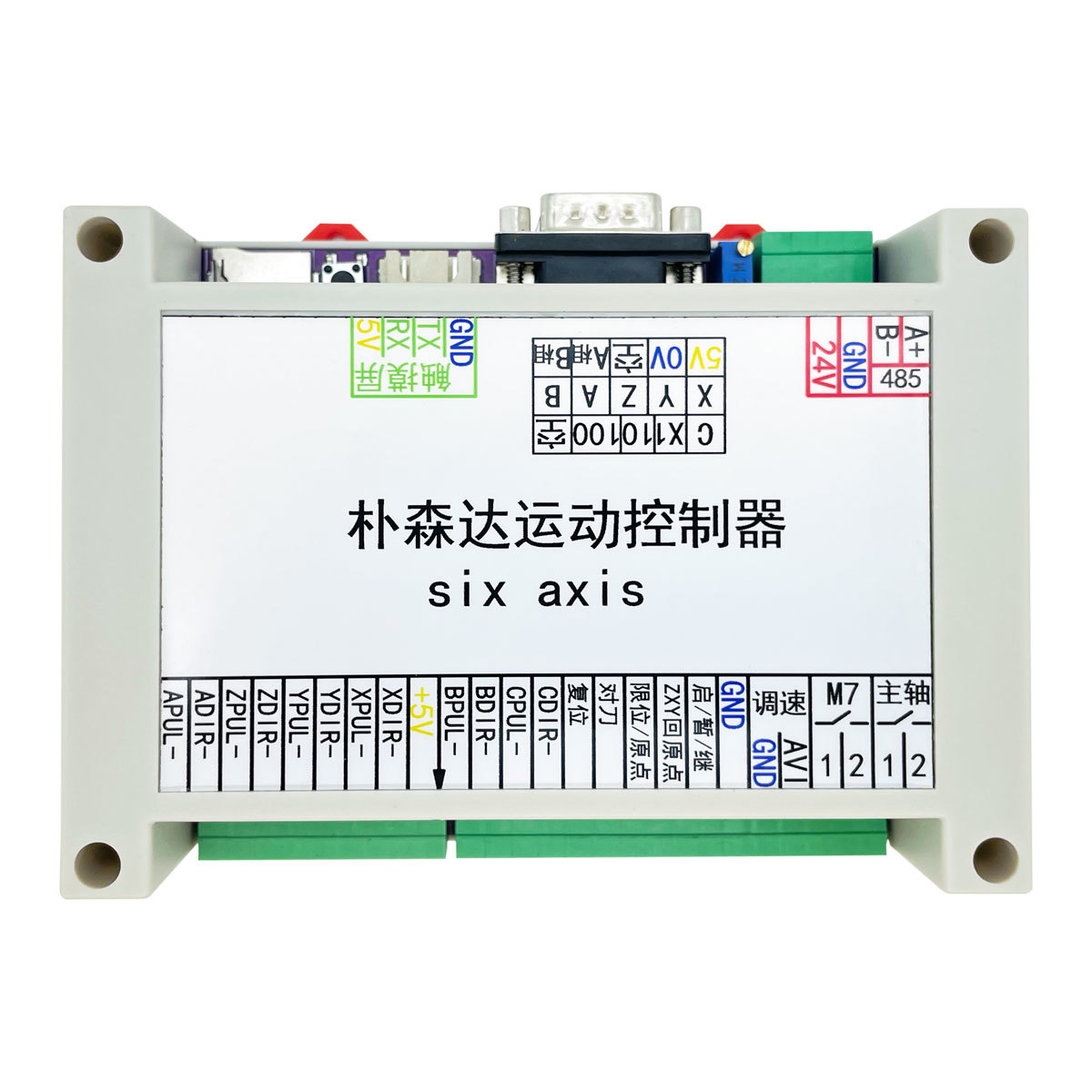

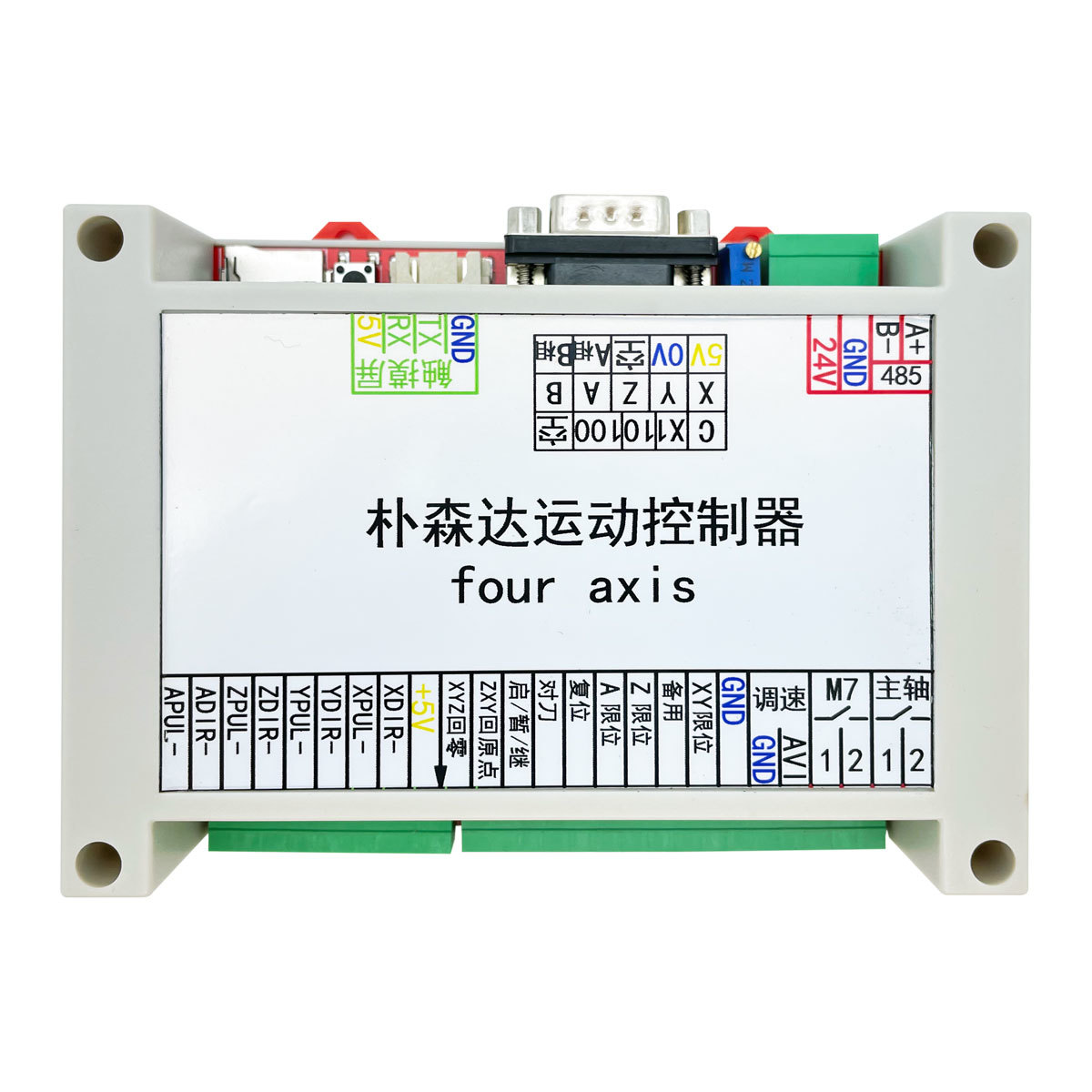

The controller is equipped with a universal model, 4-6 axis optional

A

BOUT

US

POCENDER MECHANICAL EQUIPMENT PROCESSING FACTORY

Why choose us

Focus on automation equipment to provide high-quality solutions

Continuous research and development and upgrading, its own research and development team, free technical support!

Excellent performance and reliability, at the same time has a more competitive price-performance ratio! Stable and fast batch supply!

Support large file processing! (single file within 3GB) zero loading time, 24 hours of continuous operation.

With speed forward-looking, 2000 lines of small line segment pre-operation, smooth and silky, efficient processing!

POCENDER uses the mature and stable RTCP algorithm of Heidenhain and Fanuc, which is simple and Effortlessly achieves high precision, high-speed, and high stability in standalone operation. Far more than open source systems on the market today.

Company Profile

POCENDER is an enterprise focusing on the research and development of automation equipment. We are constantly developing and upgrading, committed to providing high-quality solutions.

POCENDER Standalone CNC ControlSystem is an ideal alternative to Fanuc and Siemens brands, with excellent performance and reliability, while providing a more competitive price/performance ratio. Our system can replace traditional control boards, such as Mach3 and Vimacro, providing customers with a better control experience and more efficient processing capabilities.

We are constantly upgrading and improving to ensure that our products are always at the forefront of technology. Our R & D team actively explores new technology trends and practices, and collaborates with industry partners to capture new technological achievements. We are committed to providing high-performance, high-reliability and high-flexibility solutions to provide customers with continuous value-added.

P

RODUCTION

ENVIRONMENT

N

EWS

CENTER